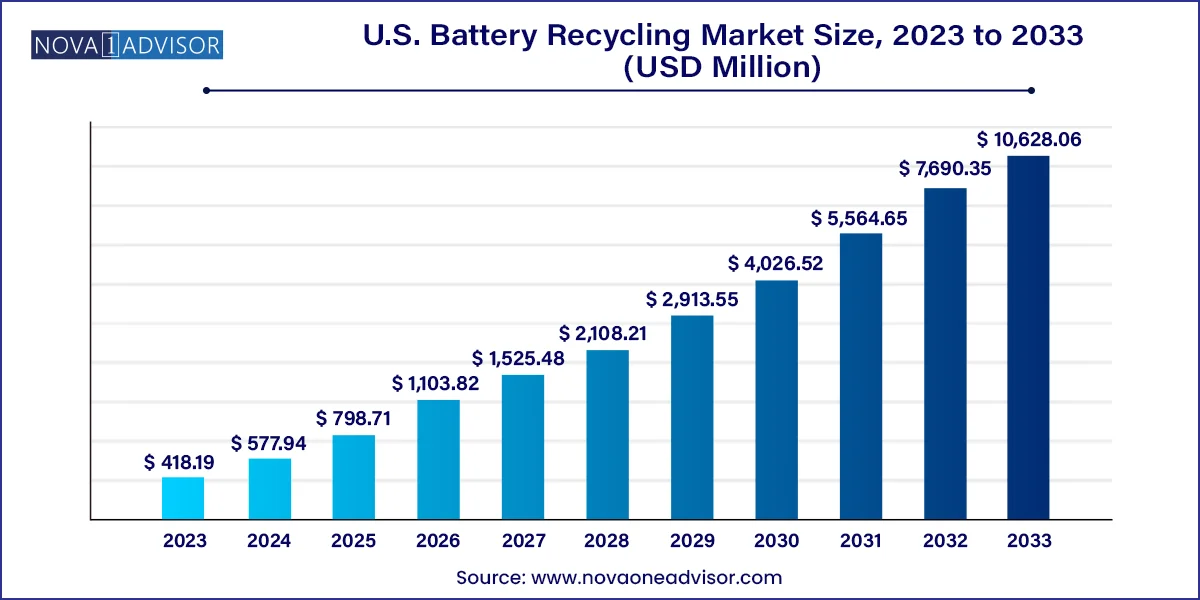

The U.S. battery recycling market size was valued at USD 418.19 million in 2023 and is anticipated to reach around USD 10,628.06 million by 2033, growing at a CAGR of 38.2% from 2024 to 2033.

The U.S. Battery Recycling Market is emerging as a strategic pillar in the country’s energy transition and circular economy roadmap. With the growing adoption of electric vehicles (EVs), consumer electronics, and industrial energy storage systems, the demand for batteries — particularly lithium-ion and lead-acid chemistries — has surged dramatically. However, this increasing consumption has created an urgent need to develop robust recycling infrastructures to manage end-of-life batteries sustainably, reduce environmental risks, and mitigate dependence on critical raw material imports.

Battery recycling addresses several critical challenges, including hazardous waste management, recovery of valuable metals such as lithium, cobalt, and nickel, and the creation of a closed-loop supply chain. As the United States aims to strengthen its domestic battery manufacturing ecosystem, recycling has become a key enabler of supply chain resilience. Notably, the Inflation Reduction Act of 2022 recognizes recycled materials as eligible inputs for EV tax credits, thereby incentivizing automakers and battery producers to source recycled metals locally.

The U.S. Department of Energy (DOE) has also launched the Battery Recycling Prize and the Lithium Battery R&D Program, committing significant resources toward innovation, public-private partnerships, and commercialization of recycling technologies. In parallel, a growing number of start-ups and established players are investing in advanced hydrometallurgical and direct recycling methods that promise higher metal recovery rates and reduced energy consumption compared to traditional pyrometallurgical processes.

With projected battery waste volumes expected to exceed 2 million metric tons annually by 2035, the U.S. battery recycling market is poised for exponential growth. This transformation is not just an environmental imperative but a strategic opportunity to establish the U.S. as a global leader in sustainable battery supply chains.

Proliferation of lithium-ion battery recycling technologies: Increasing R&D into hydrometallurgy and direct recycling methods for higher recovery efficiency and reduced emissions.

OEM integration of recycling into supply chains: Automakers like Ford and GM are partnering with recyclers to create closed-loop battery ecosystems.

Second-life battery utilization prior to recycling: Batteries from EVs and grid storage are being repurposed for secondary applications before final recycling.

Expansion of domestic recycling capacity: New plants are being commissioned across the U.S. to reduce reliance on exports and meet federal policy goals.

Development of urban mining models: Collection and extraction of metals from spent consumer electronics and used batteries are gaining momentum in metropolitan areas.

Legislative momentum around Extended Producer Responsibility (EPR): States like California are exploring mandates requiring manufacturers to take responsibility for battery end-of-life.

AI and robotics in battery dismantling: Emerging technologies are being deployed for efficient, safe, and automated sorting and disassembly.

| Report Attribute | Details |

| Market Size in 2024 | USD 577.94 million |

| Market Size by 2033 | USD 10,628.06 million |

| Growth Rate From 2024 to 2033 | CAGR of 38.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Chemistry, application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Call2Recycle; Exide Technologies; Cirba Solutions; American Battery Technology Company; Gopher Resource; East Penn Manufacturing Co.; Aqua Metals |

The single most powerful driver of the U.S. battery recycling market is the explosive growth in electric vehicle adoption. With federal and state governments setting ambitious targets — such as California’s 2035 ban on new internal combustion vehicle sales — millions of EVs will be hitting American roads in the coming decade. Each EV contains large lithium-ion battery packs that will eventually require responsible disposal or recycling.

By 2030, it is estimated that over 11 million EV batteries in the U.S. will reach the end of their useful life. These batteries, while no longer efficient for automotive propulsion, still contain significant quantities of recoverable materials such as lithium, nickel, cobalt, and copper. Recycling these batteries not only helps prevent toxic waste leakage but also creates a domestic supply of critical materials, reducing dependence on volatile foreign markets.

Several automakers are already preparing for this wave. General Motors, in partnership with Li-Cycle, is working to recycle scrap from battery manufacturing processes, while Tesla has pledged to recycle 100% of its battery packs. As this wave of EV adoption gains pace, the recycling sector will play an increasingly essential role in ensuring environmental compliance, supply chain circularity, and cost optimization.

While the need for battery recycling is urgent and undeniable, the market is constrained by a range of technical and logistical barriers — the foremost being the complexity and lack of standardization in battery designs. Modern batteries, especially lithium-ion chemistries, come in various sizes, formats (pouch, cylindrical, prismatic), and compositions (LFP, NMC, NCA, etc.), making dismantling and material recovery both time-consuming and hazardous.

Moreover, current recycling methods such as pyrometallurgy involve high energy consumption and generate emissions, while hydrometallurgical approaches require significant water and chemical inputs. Direct recycling, while promising, is still in the early stages of commercialization and requires precise disassembly techniques to preserve battery cathodes.

The absence of universal labeling, dismantling guidelines, and tracking mechanisms further complicates operations. For recyclers, this translates into higher operational costs, safety risks, and inconsistent recovery yields. Until battery designs are optimized for recyclability and industry-wide standards are adopted, these constraints will continue to slow down scalability and profitability.

A compelling opportunity lies in leveraging battery recycling to enhance national security and reduce dependence on foreign-sourced critical minerals. The U.S. currently relies heavily on imports for lithium, cobalt, and nickel — materials essential for battery production but sourced from geopolitically sensitive regions. Recycling offers an economically viable and environmentally responsible way to recover these materials domestically.

Recognizing this, the Biden Administration has included battery recycling in the National Blueprint for Lithium Batteries and allocated funding through the Bipartisan Infrastructure Law and CHIPS Act. These initiatives aim to establish a robust, circular battery ecosystem in the U.S., supporting manufacturing, research, and end-of-life management.

Companies that invest in advanced recycling infrastructure can position themselves as key suppliers to automakers and energy storage developers seeking IRA-compliant materials. Furthermore, the emerging second-life battery market offers dual value before recycling — enabling reuse in applications like grid storage, backup power, or telecom systems. This multi-stage value creation makes recycling not just an environmental strategy but a cornerstone of America’s clean energy economy.

The lead-acid segment dominated the market with a revenue share of over 89.18% in 2023. With recycling rates exceeding 95%, lead-acid batteries represent one of the most successful circular economy models in existence. Established reverse logistics networks, stringent disposal regulations, and mature technologies have made lead-acid recycling both efficient and profitable.

Major players operate large-scale lead-acid recycling plants, where batteries are mechanically broken down and refined into lead ingots, plastic casings, and sulfuric acid components. Despite their dominance, however, the lead-acid segment’s growth is flattening due to declining usage in favor of newer battery chemistries.

Lithium-ion batteries are the fastest-growing chemistry segment. Driven by the electric vehicle boom and proliferation of consumer electronics, Li-ion batteries are being generated at unprecedented rates. However, their complex chemistries, high voltage, and flammability make recycling challenging. In response, companies like Redwood Materials, Li-Cycle, and Ascend Elements are pioneering hydrometallurgical and direct recycling methods to recover critical metals from Li-ion cells at scale. As production and disposal volumes grow, lithium-ion battery recycling is set to outpace other chemistries, making it the most dynamic segment in the market.

The transportation segment was the largest application segment in the U.S. battery recycling market with a revenue share of over 66.43% in 2023. owing to the sheer volume of lead-acid batteries used in traditional vehicles and the rising tide of electric vehicle battery waste. Commercial vehicle fleets, logistics providers, and automotive service centers contribute significantly to the battery recycling supply stream. With EV batteries now reaching end-of-life, transportation is not only dominant but increasingly diverse in the chemistries it supplies for recycling.

Automakers are also taking active steps to integrate recycling into their production ecosystems. Tesla, GM, and Ford have announced plans to develop in-house or partner-based recycling systems to handle both production scrap and end-of-life packs. Transportation remains the bedrock of the recycling industry due to consistent volume and policy-backed incentives for responsible disposal.

Consumer electronics is the fastest-growing application segment. The average American household possesses multiple battery-powered devices — smartphones, laptops, tablets, wearables — and their life cycles are shortening. As consumer awareness of e-waste grows and states strengthen take-back laws, recycling volumes from this sector are surging. Tech companies like Apple have launched trade-in programs and disassembly robots like “Daisy” to recover materials efficiently. Urban mining — the process of extracting precious metals from discarded electronics — is rapidly evolving into a high-yield recycling niche.

The United States is undergoing a transformative shift in how it manages battery waste, driven by policy, technological innovation, and mounting environmental awareness. While traditionally reliant on exporting battery scrap to Asia for processing, the U.S. is now investing in domestic capacity to reclaim strategic autonomy over critical materials.

States such as California, New York, and Michigan are leading the charge with legislation mandating responsible battery disposal and recycling, often backed by funding grants for recycling infrastructure. For instance, California’s SB 1215 aims to regulate battery-containing products, while the state’s CalRecycle program supports recycling pilot projects.

Federal action has also been pronounced. The U.S. Department of Energy has provided funding to projects developing cost-effective recycling technologies, and the Department of Defense is evaluating battery recycling as a supply chain resilience tool. Meanwhile, the Environmental Protection Agency (EPA) has introduced guidelines to improve the safety of battery collection, transport, and processing.

Private sector investments have surged. Redwood Materials recently announced plans to build a second facility in South Carolina with the capacity to process 100,000 tons of battery material annually. Ascend Elements is constructing a commercial-scale facility in Kentucky, while Li-Cycle’s Rochester Hub in New York is positioned to be one of North America’s largest lithium-ion recycling facilities. Collectively, these developments reflect a nationwide pivot toward a sustainable and sovereign battery ecosystem.

March 2024 – Redwood Materials secured over $1 billion in DOE-backed loans to expand its battery recycling campus in South Carolina, aimed at supplying recycled lithium and nickel to U.S.-based EV battery manufacturers.

February 2024 – Li-Cycle began commissioning its Rochester Hub in New York, targeting the annual processing of up to 35,000 metric tons of lithium-ion batteries with a recovery rate of over 90% for cobalt and nickel.

January 2024 – Ascend Elements broke ground on its Apex 1 facility in Kentucky, which will recycle lithium-ion battery scrap into cathode-grade materials using its patented Hydro-to-Cathode™ process.

December 2023 – Tesla announced it had achieved a 100% in-house recycling rate for its battery production scrap at Gigafactory Nevada, and plans to expand into third-party battery pack recycling by late 2025.

November 2023 – The EPA published updated battery recycling safety guidelines, focusing on lithium-ion battery transport protocols and fire risk mitigation during storage.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Battery Recycling market.

By Chemistry

By Application